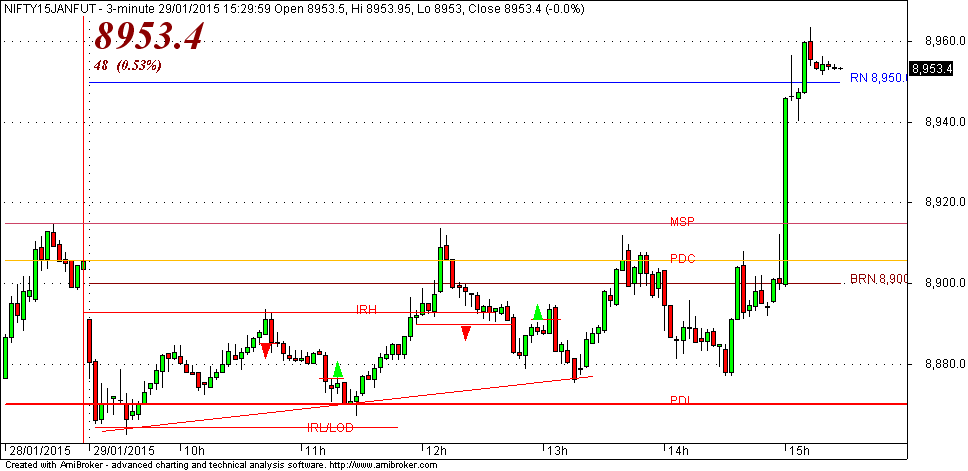

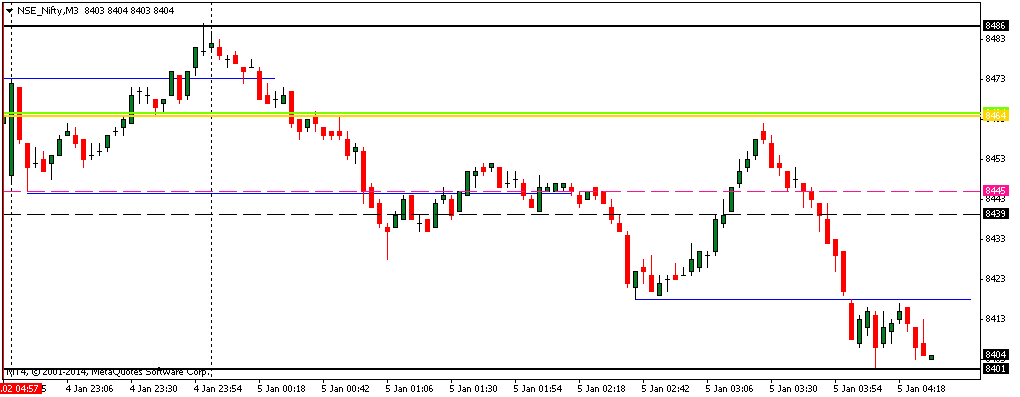

Could not trade in the first hour, as Net connectivity was an issue. Aggressive traders would have shorted BOF PDH.

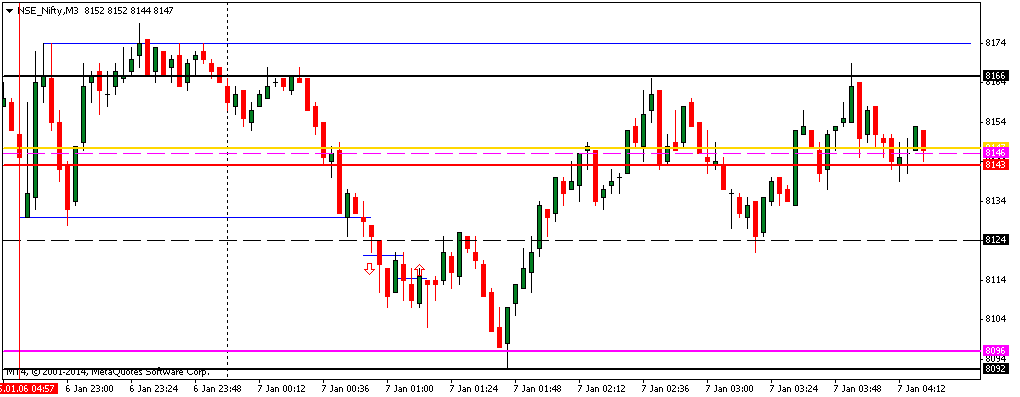

1) Wanted to short below MSP. Hesitated as already 60+ move had been completed. It moved well. 100 points move is commom these days and must change my views accordingly.

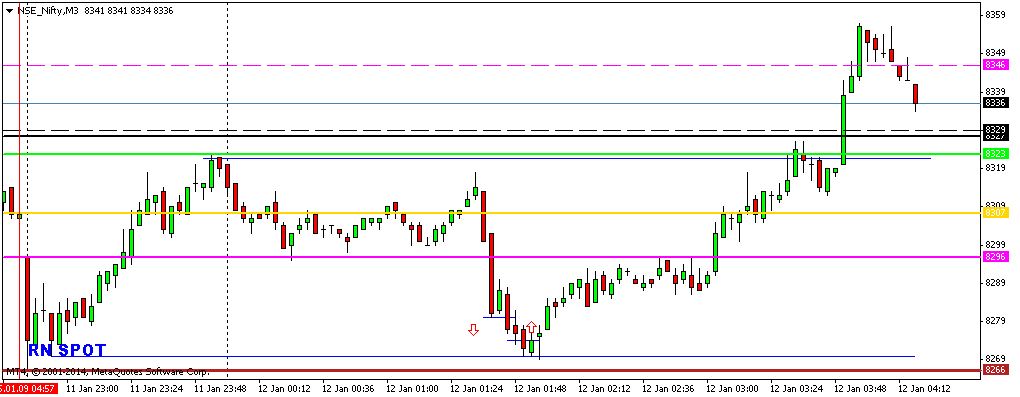

2) Was waiting for the eventual fall. Where and when were the billion dollar questions.Hesitatingly shorted after 3 attempts to move above BRN failed. As it was lunch time, had some doubts, whether the volume will be sufficient to trigger further fall. Stopped out. Gave 8 points.

3) Volumes returned after 1.30 Noon and the unavoidable fall happened after the last ditch effort by bulls failed. Waited for PB and got it after a major part of move was over. Sorted LOD BPB and got 10 points.

Results of PSU Banks seem to have triggered this fall.

Disclaimer: I am not a Research Analyst, registered with SEBI. I maintain this blog only for my own learning purpose and recording my thoughts on intraday activity of Market. I do not give any kind of trading advice to anyone. My methods will result in severe losses. Hence please do not follow me.