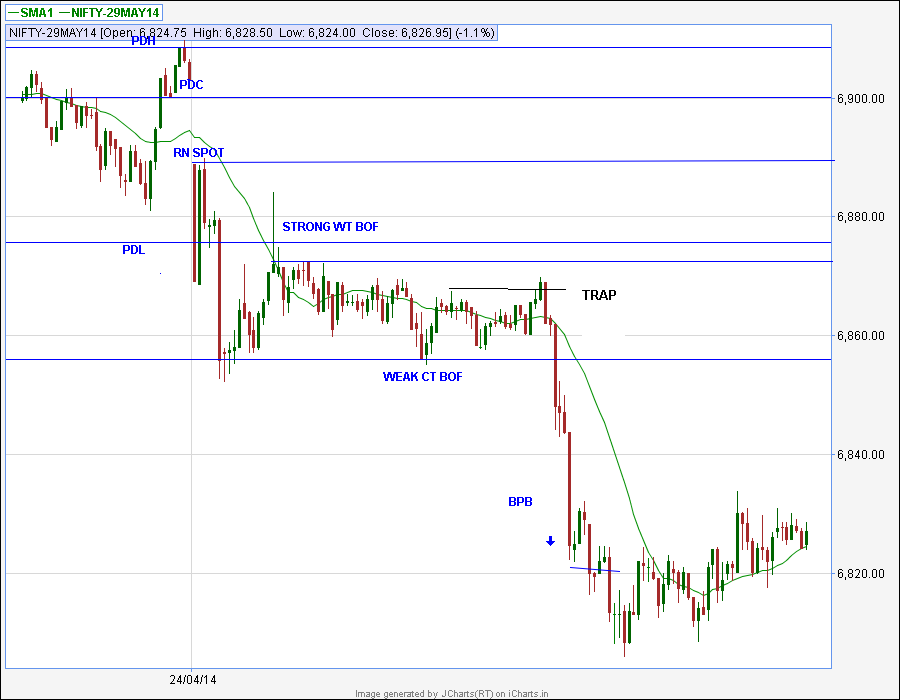

1) First day of a new Series. Marking PDH,PDL remains a problem on the first

day of a new series.Maybe, have to look only at Nifty Spot chart on the first

day.

2) Small Gap down. IRL was broken and price pulled back above PDL and got

rejected. Strong WT BOF with a penetration of more than 5 points was a good

signal to go short. Hesitated on where to short - at the BO candle low or swing

low. Strength of WT BOF influenced in a big way and placed a SL order below BO

candle low, bit late. But price moved down quickly and this order was not

filled.

Price pulled back to the level, I wanted for entry, but hesitated. Finally

placed an order below the swing low. But the momentum was very less and it

looked like the price may chop and consolidate. Hence cancelled this order too.

In the hindsight, should have shorted without hesitating on seeing such a

strong WT BOF, at BO candle low, considering the minimum space with

FTA. PULL THE TRIGGER AS SOON AS YOU SEE SUCH JUICY SET UPS.

3) After moving in a tight range for almost 3 hours, price fell sharply.

Shorted on BPB and got 8 points.

4) Didn't take CT PP Long.

Was looking for a BOF either at Day Low or BRN. But what followed was TST at

Day Low. Further

space between the entry swing picot and MSP was very less.

Hence skipped the

CT PP Long. BOF at MSP trapped all the PP Longs.Further difference between ATP and VWAP was more than 32 points and probably that is why bears were under no pressure whatsoever to exit enmasse to trigger a quick reversal.

Only one trade for the day.

ST Clarification.:

ST has clarified to another blogmate as to how he decided that price will go down(not up) after the consolidation for 3.5 hours.

My BO trade was a minor trap pattern. Notice that I have drawn a line there.

There was no upward momentum on the break of previous swing high.

If price stayed above that flip line for a while, I will look to go long on a BO. Target will be IRH

We can expect a lot of stops above this range