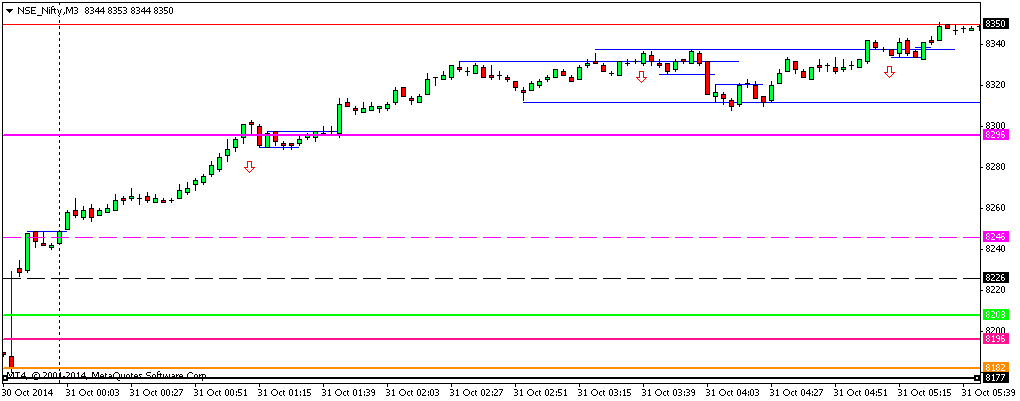

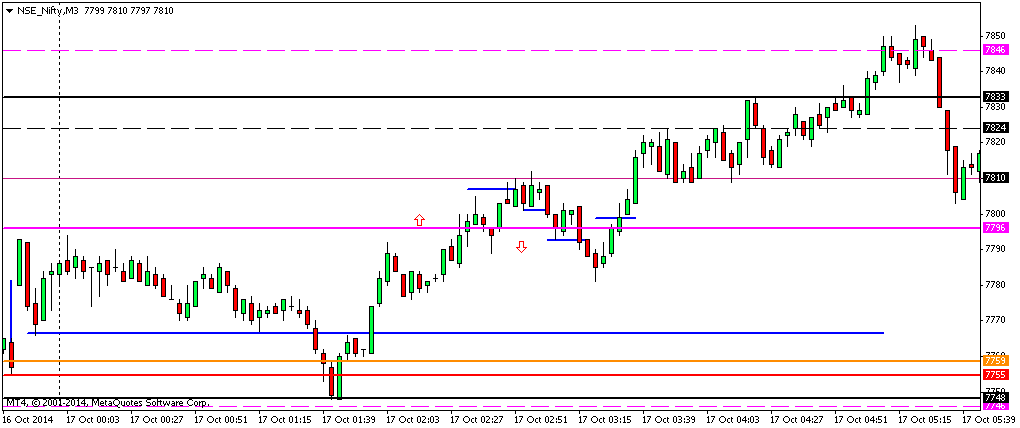

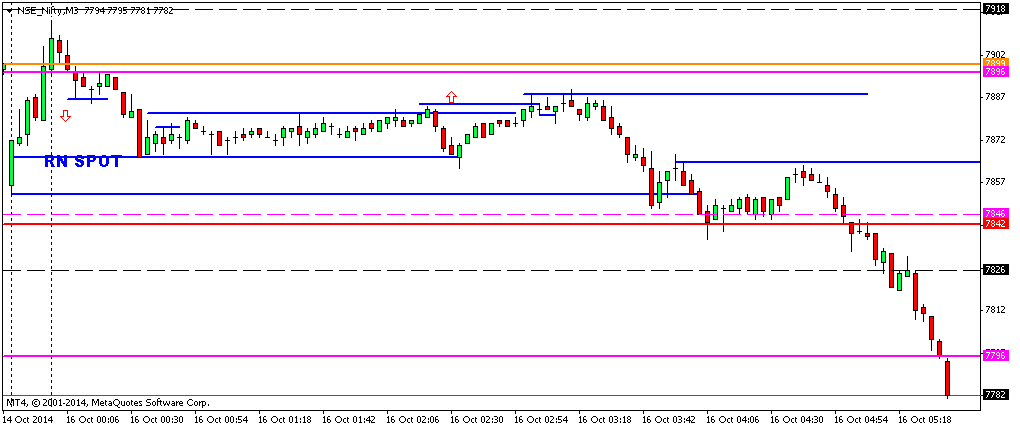

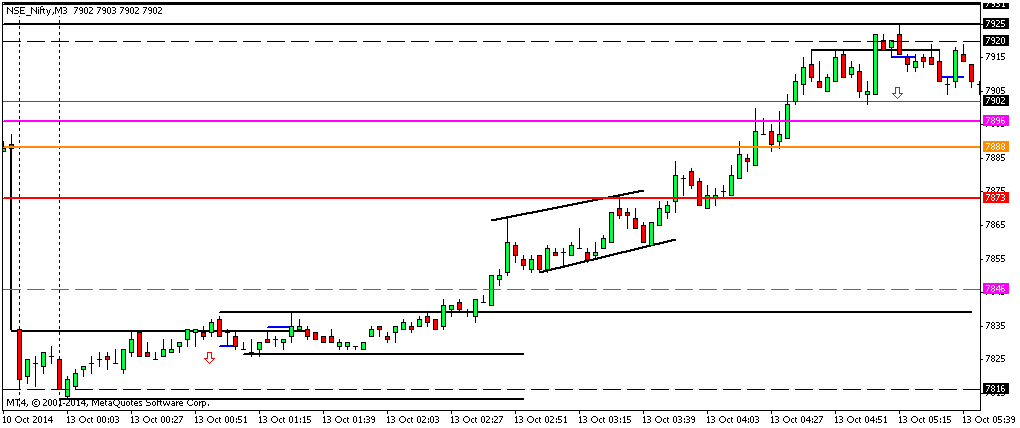

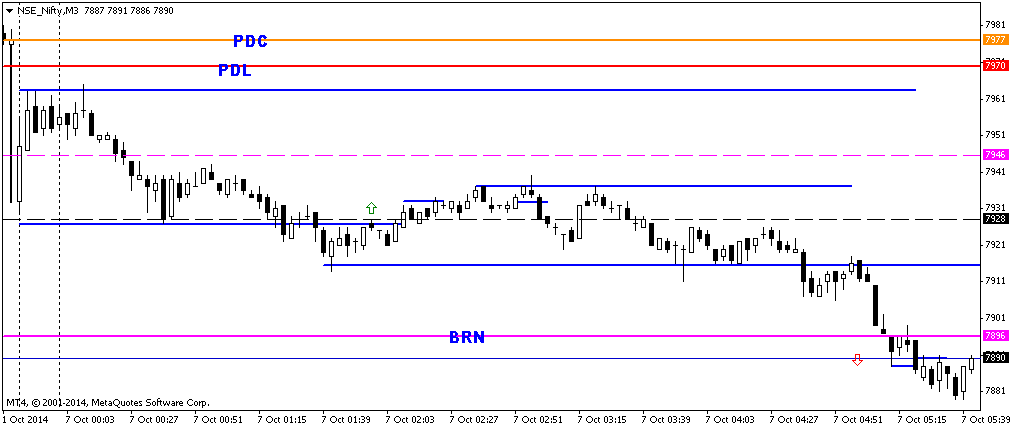

Inside Gap up at the upper extreme of the closing range of yesterday. Can be taken as BPB BRN.Low of first candle was not tested and it looked like a big up move on the way. But premium has reduced. Decided to enter Long after the formation of a clear swing high after BRN Spot was breached.When I got it, space was less with PDH. Missed the up move. Should have ignored BRN Spot and jumped in as the up move has just started. It was a risk worth taking. Lesson learnt.

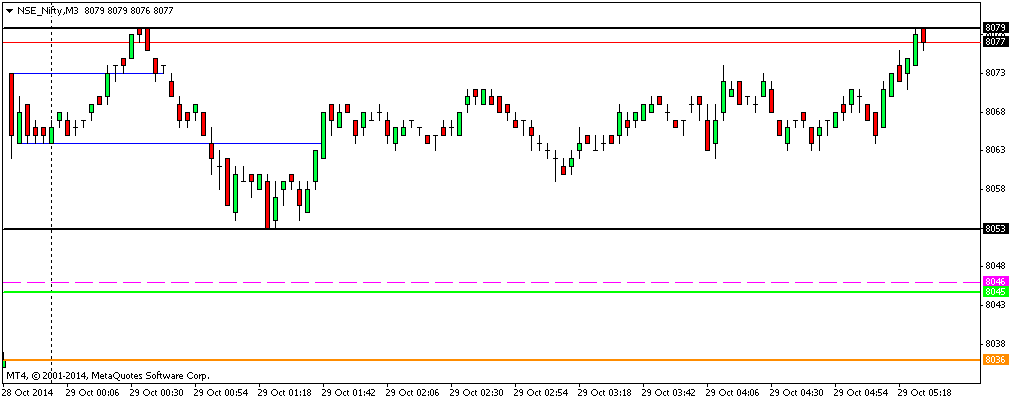

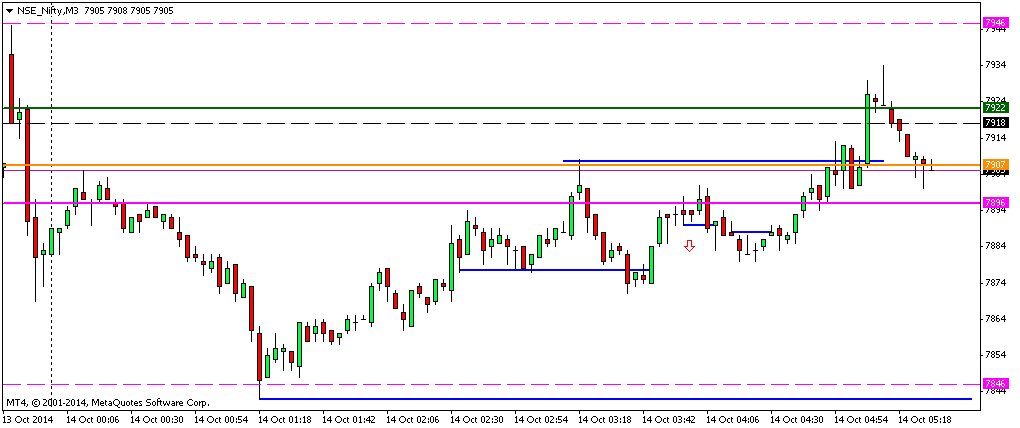

1) Did not take PDH BPB as zone around 7950 has been a strong Resistance.

2) Went for FTC short as the up move was showing signs of exhaustion. Got

27 points.

3) Went Long @ BOF of BRN.Did a silly mistake and made a premature exit. Got only

5.5 points.Realised my mistake and was trying to correct it, but my TSL was hit. A silly mistake and a fraction of a second delay resulted in not getting 28 points more.

4) Avoided FTC short above PDH, as the space was not there.

5) Avoided BOF of PDH, as it was against the exit direction of critical mass at the end of the day.

Placed the photos of kitten in my Blog. Seems to be a good omen!