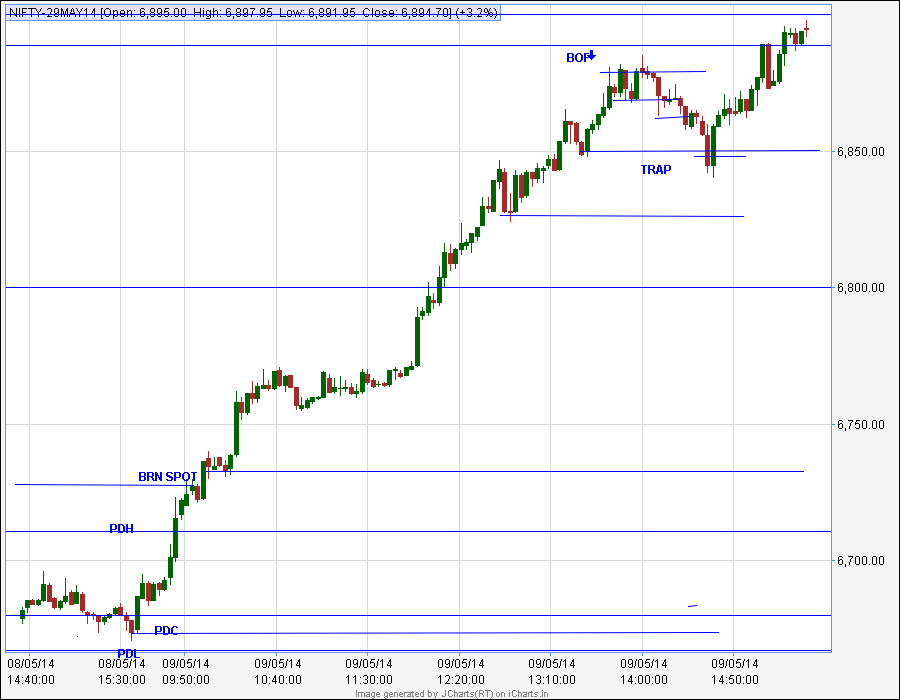

1) Opened below PDL/PDC. Resultant BOF was a very good signal. Price climbed up without giving any swing pivot for entry. Bit difficult to trade this signal.

2) Kept a Long order for the next BOF of PDL. Got confused and cancelled the order just before it got filled.

3) When price encountered IRH, kept a buy order before the completion of formation of swing pivot. Had to scratch this trade for a loss of

4 points. Focus must improve.

4) Took the BOF of PDH trade. Exited in a hurry. As the price encountered RH, moved the SL to BO candle high and got stopped out for a loss of

1 point. Learnt an important lesson - Never trail at the BO candle low/high, when price encounters RH/RL. Follow this procedure only when the price encounters these important DPs, namely PDH, PDL, and BRN.

Another mistake was - forgot to keep a fresh entry order below B/O candle low.

Tomorrow is another day.