Friday, November 28, 2014

Thursday, November 27, 2014

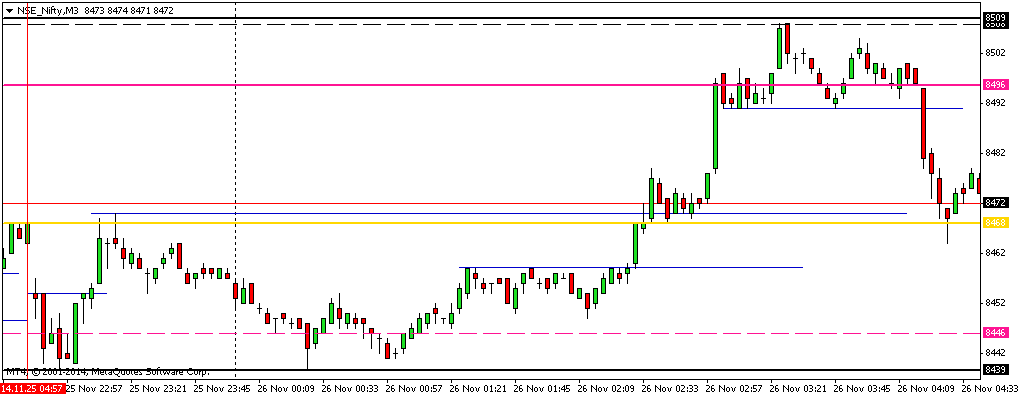

27/11/2014, FRIDAY

As MT4 switched to the next month, had to use another chart. Being expiry day, decided to look out for trades only near 8450 and 8500.

1) Big tail, indicating LOD BOF was too hard to resist. But LHLL set up inhibited me from taking this trade.

2) Took BOF of the then HOD and closely trailed. Got 13.5 points. Even a small delay in exiting would have resulted in giving away the profit.

Wednesday, November 26, 2014

Tuesday, November 25, 2014

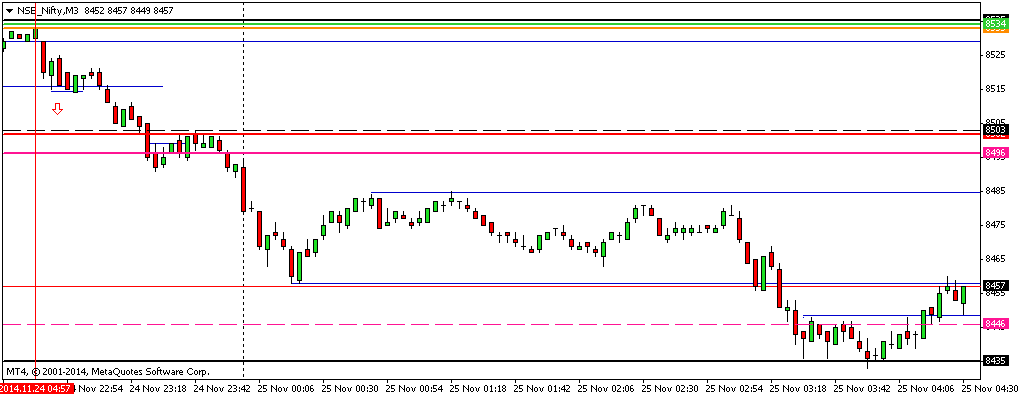

25/11/2014,TUESDAY

First candle showed strong rejection. Second candle has breached the lower extreme of the last impulse of yesterday.

1) Shorted below the second candle low. Got 14.5 points.

2) Missed BPB of BRN Short. Thought that there maybe just another 10 points movement, as Nifty has already moved 38 points. Missed 20 points trade.

3) Price consolidated for more than 3 hours and showed no signs of going up. Skipped BPB of RL/then LOD as RN was close.

4) Did not take LOD BOF as RN was too close. Further, past bitter memories of CT trades acted as a strong deterrent against taking this trade.

Looks like big boys in action, with expiry just 2 days away.

Monday, November 24, 2014

24/11/2014,MONDAY

Outside Gap opening with trend. Was expecting a Range bound day.

1) Went Long @ BOF PDH. Entered before the price settled inside IR, trusting the BOF and the location. But momentum was missing. Exited at breakeven. 0 points.

2) Did not go Long, when the price returned to IR, as there was no space.

3) BO @ HOD failed. Was not interested in shorting this BOF, as trade will be directed into 2 flip zones in a narrow range.Hence stopped trading at 3.00 PM.

Was a choppy NR day.

Friday, November 21, 2014

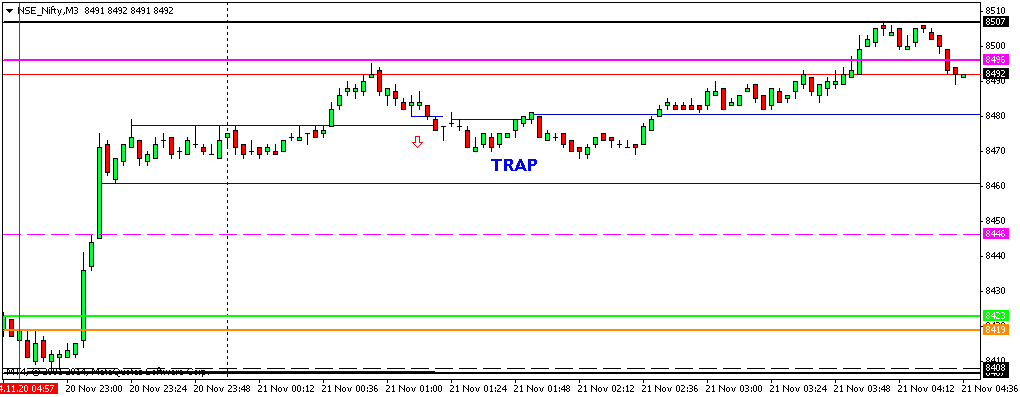

21/11/2014, FRIDAY

Opened without Gap and suddenly spiked up. Could not capture this move.

1) Took a low probability FTC Short, trusting the exit of Longs. Scratched at Break even.

2)There was a TRAP signal, followed by PP set up below BRN. Was not comfortable trading in to an all time high BRN in the closing session of Friday. Hence skipped Long above BRN.

3) Price came inside BRN after 3.00 PM. Had skipped this as well, as it came too late.

HINDSIGHT ANALYSIS

Mistake of the day.

1) Should have marked the extreme of corrective wave as Range extreme. When Range is marked correctly thus, there is no TRAP. Instead TST/FTC signal can be seen which permits early entry.

Thursday, November 20, 2014

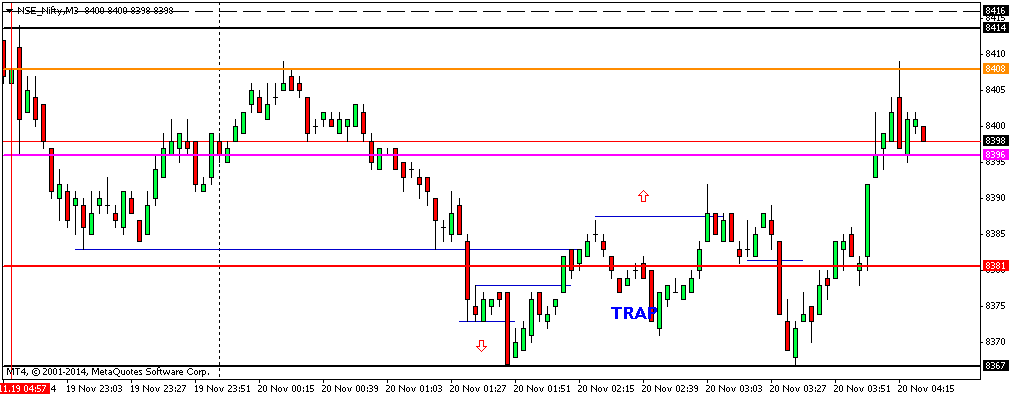

20/11/2014,THURSDAY

Price moved within the last impulse of yesterday for sometime, before breaking PDL.

1) Shorted BPB PDL. Did not go well. Gave 7 points.

2) After seeing TRAP below PDL, went Long. Expected the price to test BRN due to the exit of trapped bears. But that did not happen. Gave 6 points.

3) Did not take BPB BRN towards EOD, as this signal came bit late. Further PDC and HOD were sitting above.

Wednesday, November 19, 2014

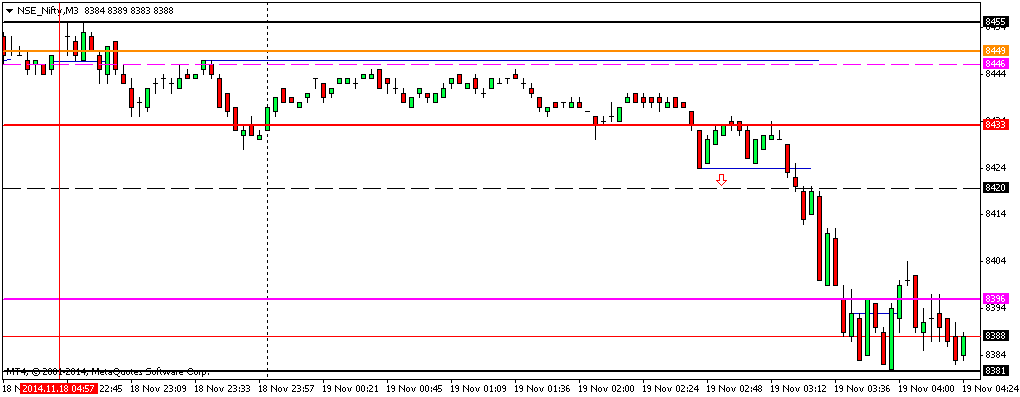

19/11/2014,WEDNESDAY

Opened without gap.

1) Did not short IRL BPB as I wanted to wait till any one of the extremes of the last impulse of yesterday to be breached.

2) Skipped BOF PDL, as the extreme of PDL has not been sufficiently penetrated. Further there was hardly 9 points space with RN.

3) Even after the extreme of PDL was broken, decided not to take BOF PDL, as the order flow suggested that bears are absorbing all the buying and panic selling may start soon.

4) Shorted BPB PDL, though BRN Spot was close, trusting the strength of the move,below the then LOD. It was also a Pattern failure. Got 30 points.

5) Did not go for BOF or BPB at BRN, as I had seen many trades at BRN failing towards the EOD, after a good move.

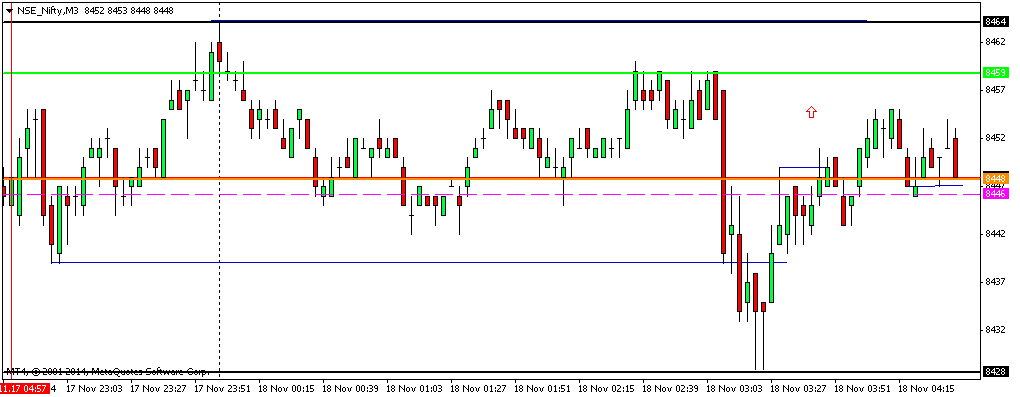

Tuesday, November 18, 2014

18/11/2014, TUESDAY

Expected a Range bound day, as there was a big move yesterday.

1) Did not go Long above PDH, as I expected some consolidation before making new all time high.

2) Took only one trade.Went Long @ BOF of LODL/TST of the RL of the last impulse of (MSP) yesterday, above RN. Did not move well. Scratched with 2.5 points.

No more trades

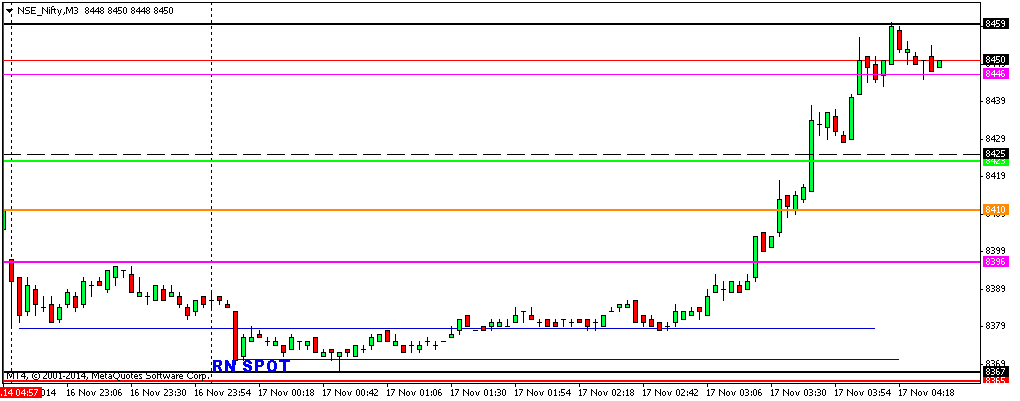

Monday, November 17, 2014

17/11/2014, MONDAY

Inside gap down opening just above BRN.

1) Did not short below IRL, as RN Spot was too close.

2) Low momentum move took the price upto BRN. Thought of going for a direct BO above BRN, but bitter memories of the past restrained me.

3) Could not enter subsequently, as PDC and PDH were closely located.

4) Did not feel comfortable trading into all time high. Hence skipped BPB PDH as well.

So no trades for the day.

Friday, November 14, 2014

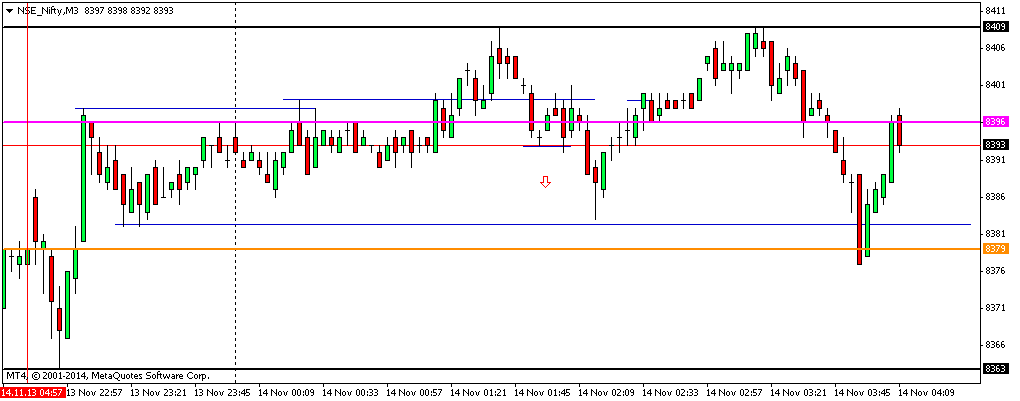

Thursday, November 13, 2014

13/11/2014,THURSDAY

Opened at the RH of the last impulse.

1) Could not capture the sudden vertical fall.

2) As PDL was above the consolidation, decided to take Long, only if TRAP appears. In the recent past, whenever PDL was above the consolidation after vertical fall, price action had been choppy. Did not get TRAP and hence avoided Longs.

3) Took FTC Long at LOD towards the end of day half heartedly. Gave 9 points.

Wednesday, November 12, 2014

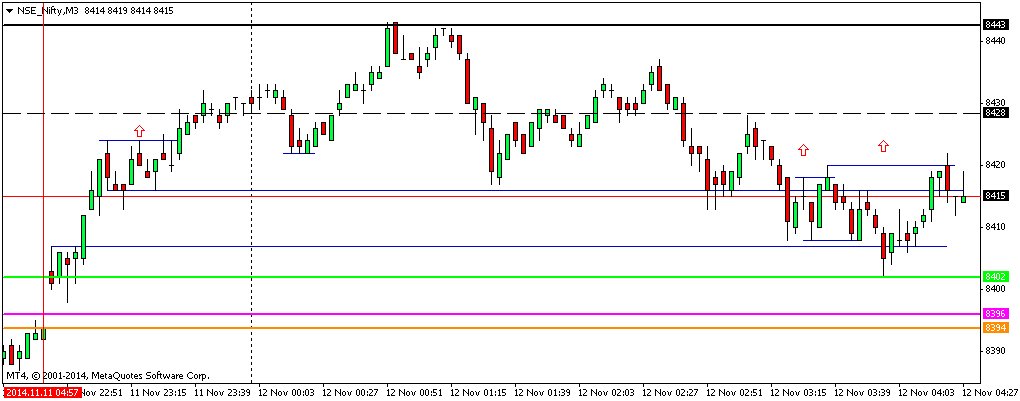

12/11/2014

Opened just above PDH.

1) Thought of going direct BO above IRH. Old bitter memories restrained me. Went Long on PDH BPB, though BRN Spot was too close. It looked like Type 1 trend day and was trailing at a safe distance. On seeing a big red candle, waited for one more candle. As price did not seem to move up, moved the TSL to the candle low to save 3 points. Price moved up after I had exited. Out of my desire to save 3 points, missed 10 points. Net result - gave away 2.5 points.

2) There was a FTC Short opportunity. Skipped it as BRN Spot was too close. Further I was expecting up trend to resume after some choppy price action.

3) Lack of focus resulted in taking a stupid CT Long trade. Stopped out. Gave 10 points.

4) Towards the end of the day, took another Long, as it looked like CPB. But it flattered to deceive. Scratched. 6 points.

Learnt a few lessons, the hard way

Tuesday, November 11, 2014

Don't let others do it for you

People's desire to mint money in stock market is being exploited by some thieves. Do not get entrapped. Click here to read the full story.

11/11/2014

Opened exactly at the upper extreme of the last impulse of yesterday. First 3 candles indicated that bulls and bears are evenly matched. Lack of clear imbalance resulted in BW around BRN.

1) It looked like the buying getting absorbed above BRN. Waited for the upper Range extreme to be penetrated strongly to consider shorts. But price fell down without giving me a chance to enter.

2) Could not short BPB PDC, as RN Spot was too close.

3) Did not short below RN Spot too, as the lower extreme of the last impulse of yesterday, which is also a FZ was closely located.

4) PDC acted as a strong Resistance. PDC BOF short could not be taken as price was moving in a channel.

5) Did not take BPB Long above PDC, as space with BRN was less. Further BPB would have been triggered only after 3.00 PM.

So, no trades for the day

Monday, November 10, 2014

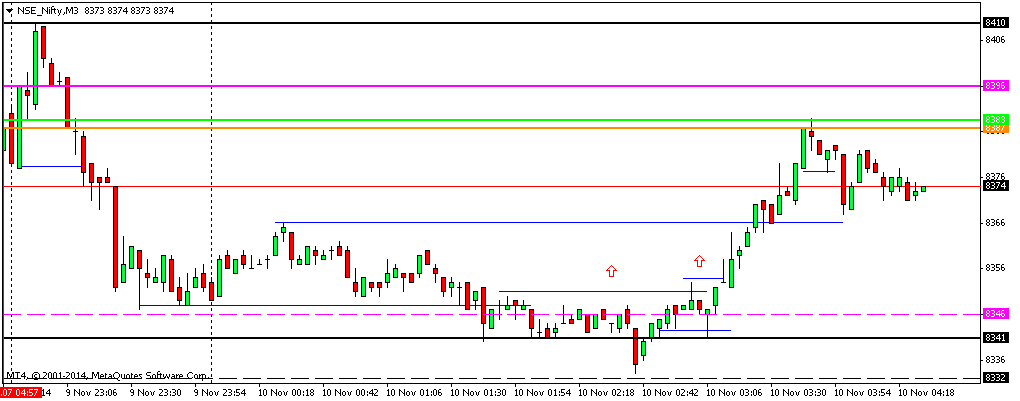

10-11-2014

Opened without gap.

1) Did not take BPB of PDH/BRN, as the zone above BRN has been acting as a strong resistance for some time.

2) It was a good BOF of BRN/PDH/PDC. There were too many levels, namely PDH/PDC/DO/lower extreme of the last impulse of the previous day. Could not fine the right place for entry in this 60 point vertical fall.

3) Initially was not interested in taking BOF of the LOD, as momentum was low.But nice engulfing candles projecting below the consolidation influenced me to go Long. Stopped out. Gave 9 points. But it was just an over shoot and price was in no mood to go down.

4) Again went Long at the same location. This time, it moved well. Got 22 points.

5) It looked like a TRAP below PDH. It morphed into FTC set up. Did not take it, as it was nearing 3.00 PM.

Friday, November 7, 2014

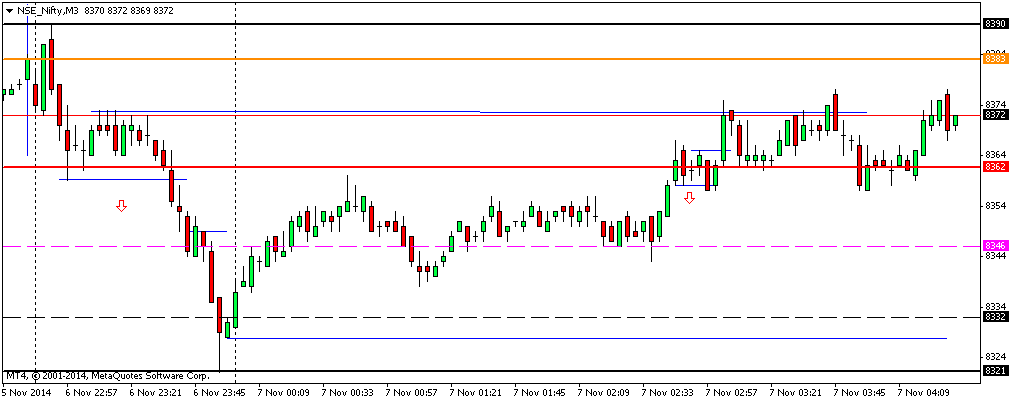

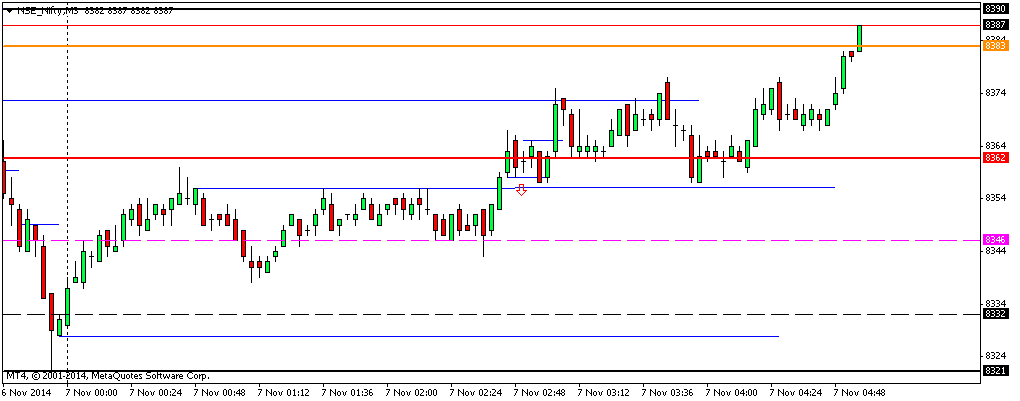

7/11/14

Opened without gap.

1) Price fell down. Did not take BOF PDL long, as the penetration was less.

2) Shorted BPB PDL. Made a premature exit. Got only 8 points. Should have got at least 13 points more with better trailing.

3) Shorted BOF PDL. Stopped out. -8 points. In the hindsight, after checking Daveji's trades, could understand that the problem was in Range marking. I assumed that since PDL was too close, it could be taken up as the Range high. Had I marked the Range high below PDL,(as per the below chart) I would have waited for the price to come inside the Range before taking the trade. Thanks Daveji.

Wednesday, November 5, 2014

5/11/2014

Opened just below PDH with inside gap up.

1) Went Long on BPB of PDH. Expected price to at least BRN. Not to be. Stopped out. -8 points.

2) What followed was Absorption just below BRN. Took FTC short at the breach of consolidation low. Got 10 points.

3) Hesitatingly shorted BOF PDH, hoping that tomorrow being holiday, longs will be exiting. Stopped out. -6 points.Should have followed the good old rule of trading only at Range extremes, in case of NR days.

4) Did not short BOF BRN as it was already 2.55 PM.

Monday, November 3, 2014

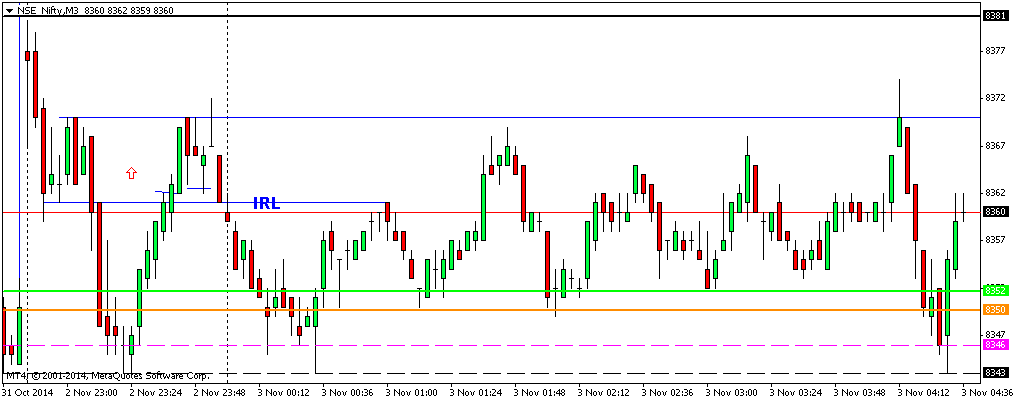

3/11/2014,MONDAY

WT outside gap up opening and got sold off. Expected a Range bound day, as the last trading day was a big move day.

1) Did not short IRL BPB, as PDH,PDC, RN and BRN spot were closely located.

2) Took PDH BOF Long after price had come inside IR. Had to exit exactly at the entry price. 0 points. Price didn't even test DO/HOD and this indicated that bears are in control for the time being.

3) Did not take the second PDH BOF, as the Range extreme was not broken.

4) There was a BOF at RH towards the EOD. There was a small consolidation bar on the way and expected the price to pause. But price fell down too quickly without letting me enter.

No other trades.

Subscribe to:

Posts (Atom)