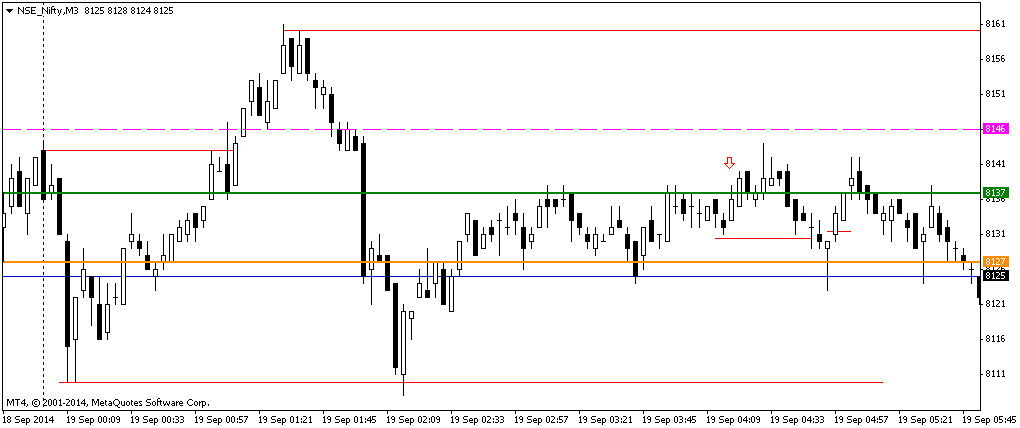

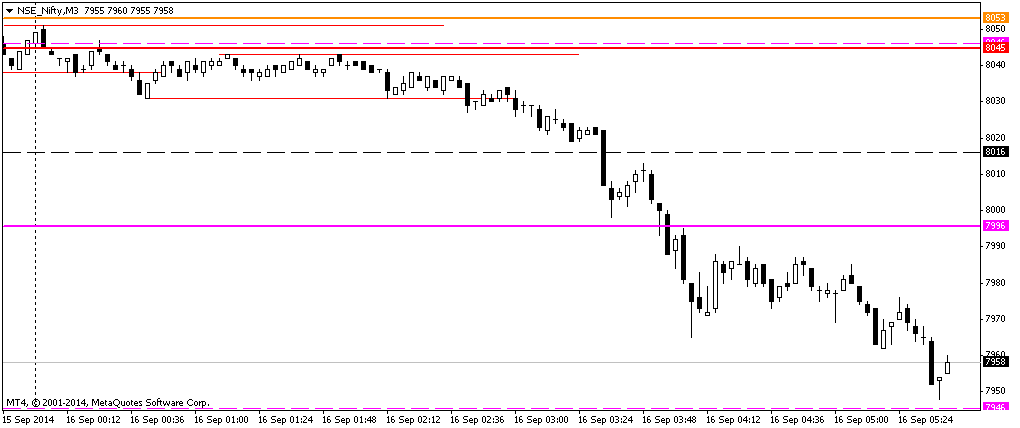

RBI announcement day. So no question of trading till Market

settles down after the announcement is over.

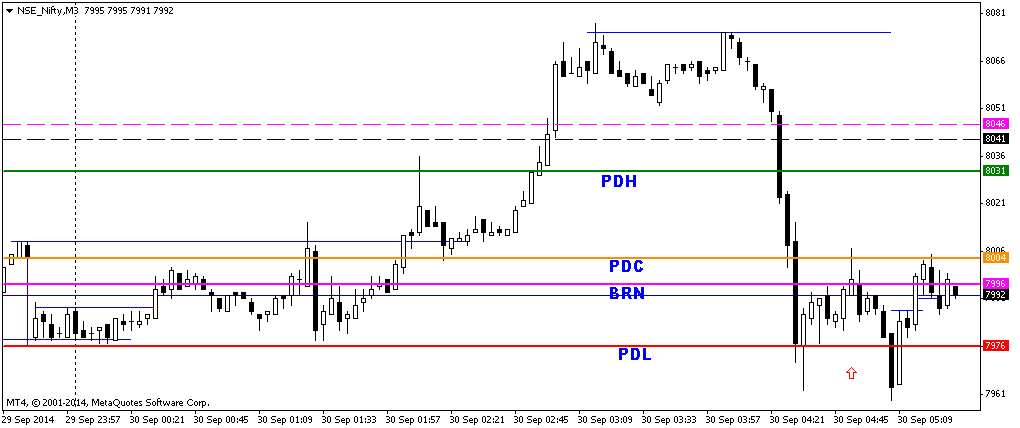

1)After the

announcement, price moved from PDL and

hit PDH. Looked like a very good BOF, Was waiting for the

price to settle below PDC to initiate short. But price moved up briskly, as if it is a Pattern failure. Did not

go long above PDH at the breach of earlier swing high as BRN Spot and RN were closely located. Turned

out to be a good move.

2)FTC noticed at HOD and price fell vertically. Again could

not find the right place for entry. Price easily broke PDL in no time.

3)Took the BOF of PDL

long towards the end of the day. BRN resisted and had to scratch. Got 4.5 points.