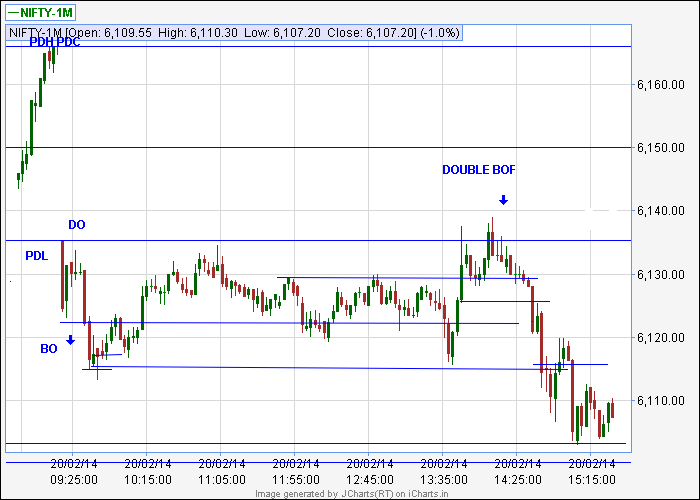

First day of a new contract. Marked PDH.PDL and PDC after adjusting the premium. That was the first mistake, as all the markings were wrong.Should have taken the March -14 chart and marked the PDH, PDL and PDC as they are.(as Rajeshji had done)

Secondly, was looking only for short in the afternoon, as I expected the swing traders to exit their positions, as today is Friday. Was unaware that yesterday being the expiry day, all the swing traders would have exited yesterday. Took the FTC short and paid with SL.

Market was very very choppy throughout the day. Rules must be framed for the first day of a new contract.