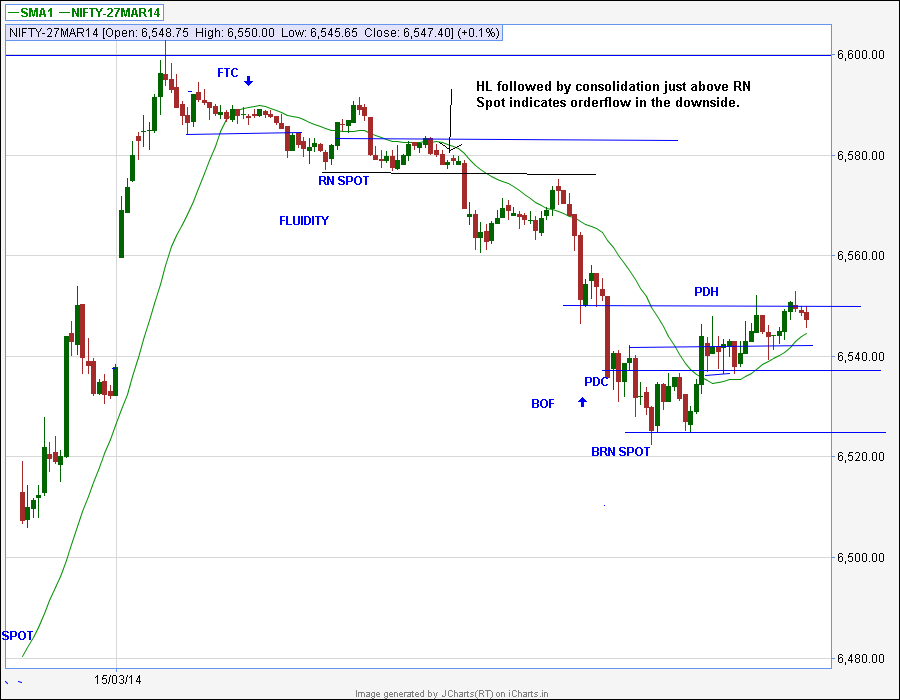

1) Gapped up and a very tight narrow range was formed. LH indicated the downward order flow. Didn't short due to want of space - RN and BRN Spot were closely located.

2) Price was consolidating above BRN Spot, followed by BOF of PDC/PDH. Didn't want to take that CT Long, until RH was broken. Despite of BOF, price moved back towards PDC/PDH after making yet another LH, confirming the strength of downward orderflow. Did not go for a direct BO of PDC/PDH, the recent BOF inhibiting against such a trade. Should have gone for the direct BO, after seeing so many factors favoring such a trade.

3) PDC/PDH was firmly broken. Didn't get any PB. So missed the trade.

4) FTC of Day Low prompted to go Long above the MSP. Exited in haste, on seeing a big red candle at break even. Even Flip zone was not broken and price moved 25 points above, after consolidating for a while. The candle at 3.00 PM, (obviously the Day players exiting) was too good to be missed. Missed at least 20 points, due to poor trailing.