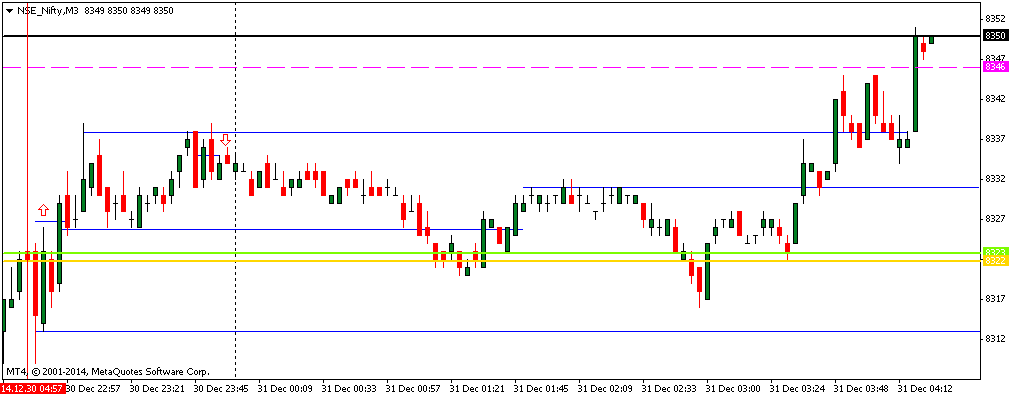

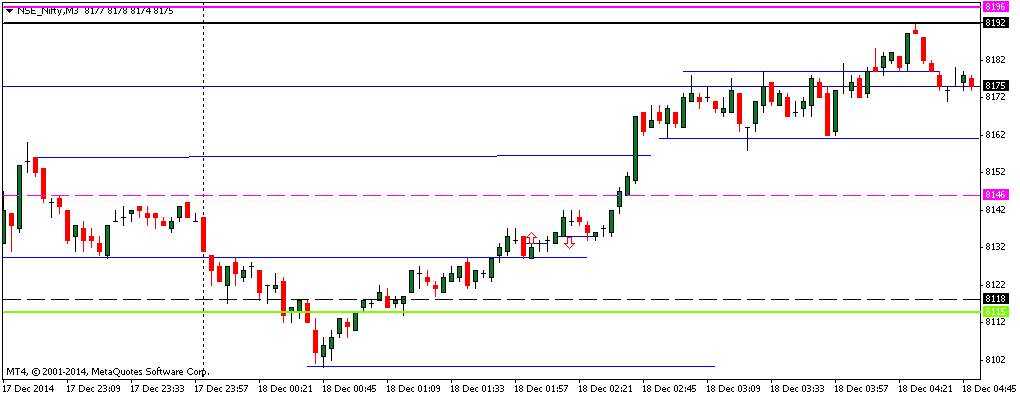

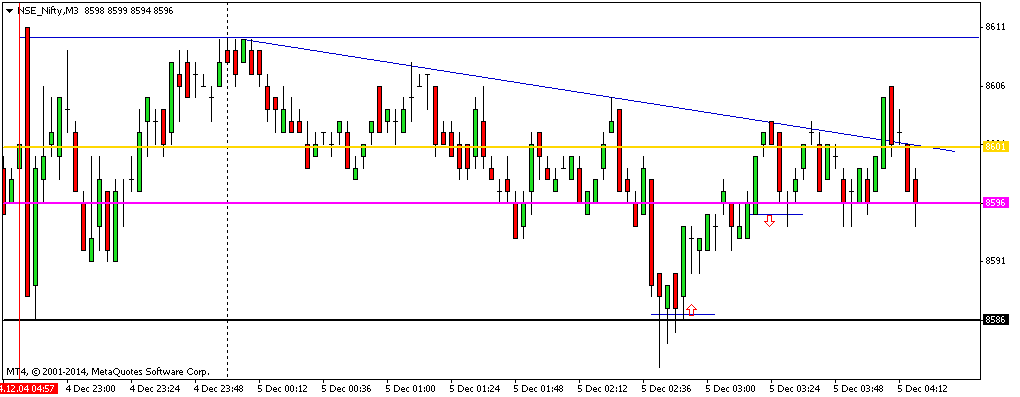

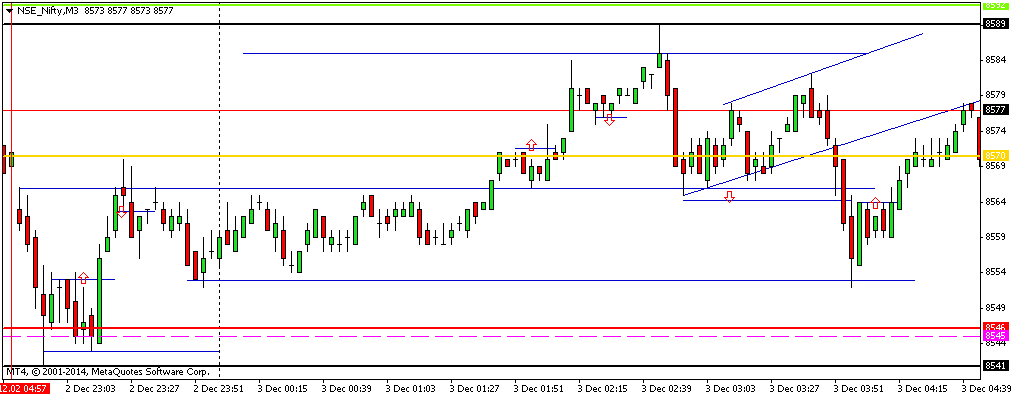

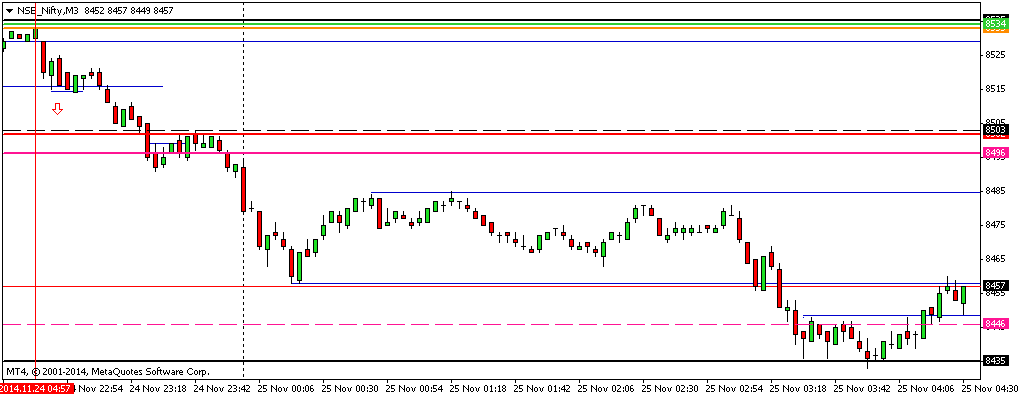

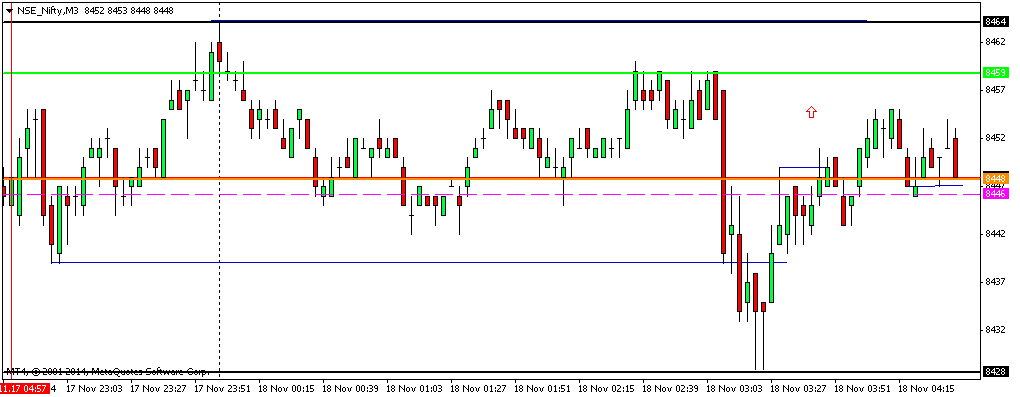

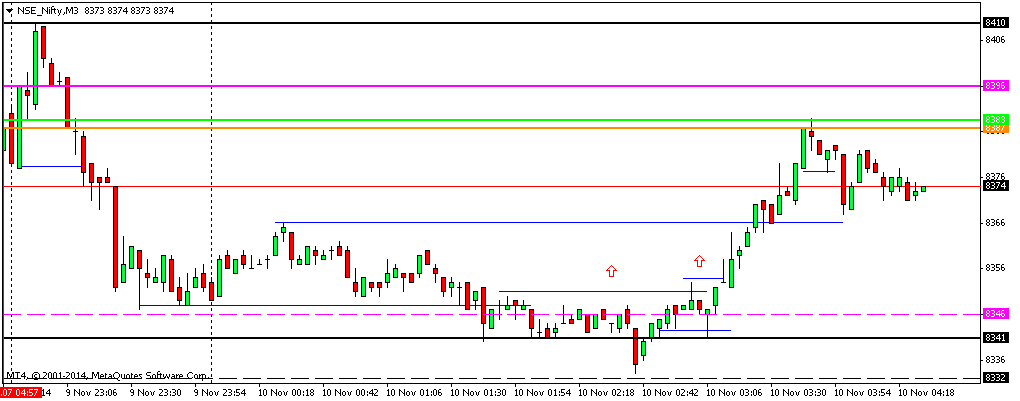

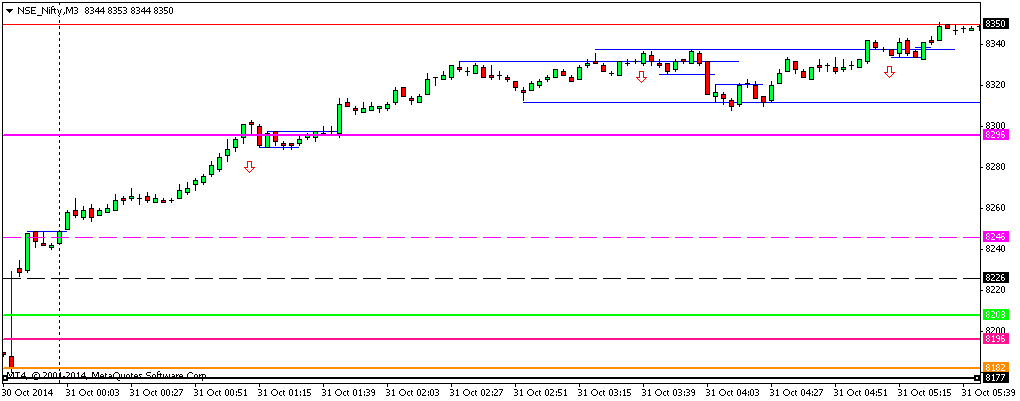

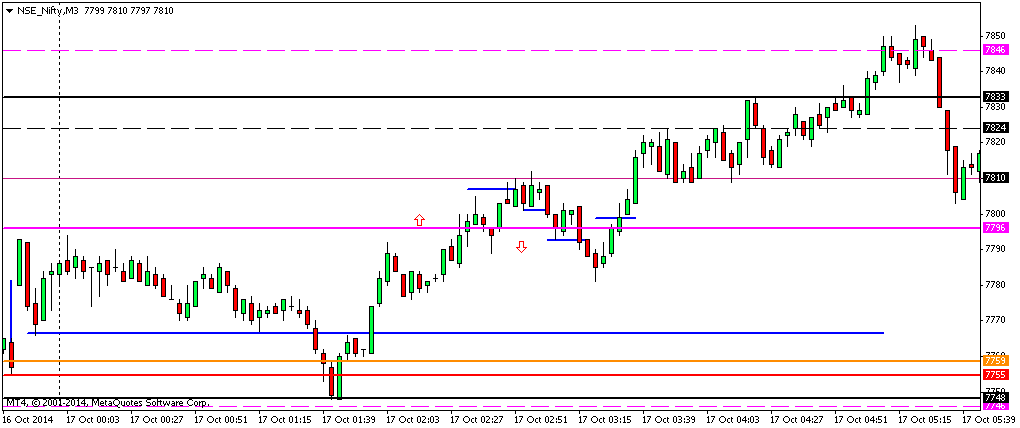

1) Longed @ BPB PDH. Got 8 points.

Did not take any trade after that, as I felt volume was less.

Learnt many lessons in 2014 the hard way. Hope that the lessons will pay good dividends in the coming years.

WISHING EVERYONE A VERY VERY HAPPY, PROSPEROUS AND PROFITABLE NEW YEAR.

Disclaimer: I am not a Research Analyst, registered with SEBI. I maintain this blog only for my own learning purpose and recording my thoughts on intraday activity of Market. I do not give any kind of trading advice to anyone. My methods will result in severe losses. Hence please do not follow me.

Did not take any trade after that, as I felt volume was less.

Learnt many lessons in 2014 the hard way. Hope that the lessons will pay good dividends in the coming years.

WISHING EVERYONE A VERY VERY HAPPY, PROSPEROUS AND PROFITABLE NEW YEAR.

Disclaimer: I am not a Research Analyst, registered with SEBI. I maintain this blog only for my own learning purpose and recording my thoughts on intraday activity of Market. I do not give any kind of trading advice to anyone. My methods will result in severe losses. Hence please do not follow me.