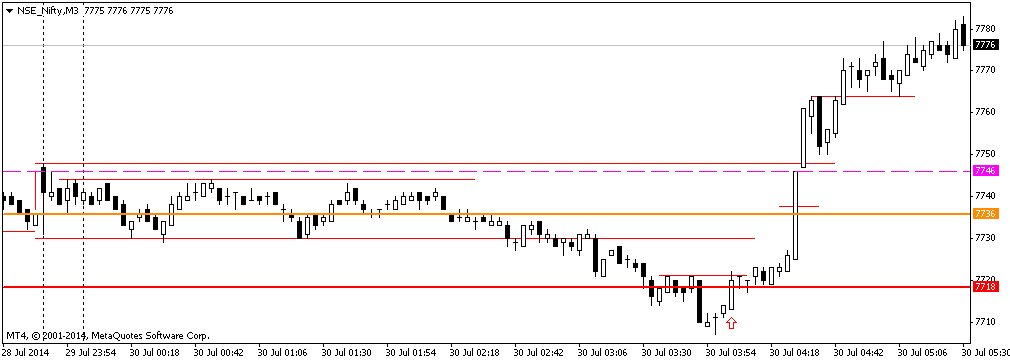

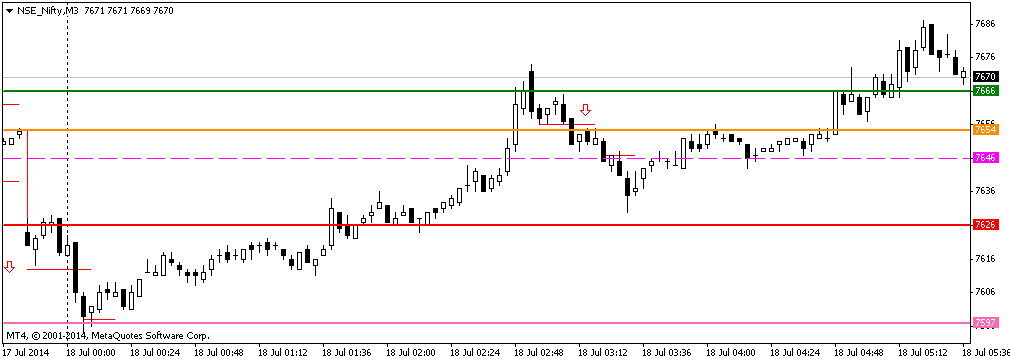

Mild Gap up, Initial move was down.

1) Narrow IR with a BW pattern around PDC

2) Didn’t short BPB IRL, as

a) rejection was

very good,

b) Momentum on the BO

side was very less

c) PDL was located

at less than 9 points space.

3) 2 LEGGED BOF of PDL was a very good signal. Exited at PDC for 15 points. Expected a bounce from PDC/IRL/RN. But it moved well, thanks to the strength of mighty 2 legged PDL BOF. Could have got 50 points

easily.

No more trades