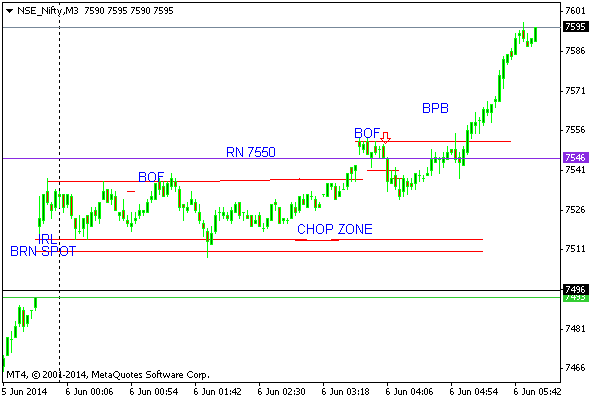

IR Marking: First candle had a big lower tail and third one, a big upper tail. These were marked as IR, tentatively. When price came down, it respected the first candle low. So no need to adjust IRL.

On going up, price was resisted just a little ahead of third candle high. So, IRH had to be slightly adjusted.

1) BOF or BPB of IRH?

5 candles formed a micro consolidation bar at IRH, indicating order accumulation. Didn't go for a direct BO Long, as RN was closely located. Was right and it turned out to be a BOF with a nice swing low for entry.

Wanted to short this BOF. Was a little late in entering the order and price moved, without filling my order.

2) BOF of IRL: Can't go for a direct BO of IRL, as there was not sufficient order accumulation at IRL to get sufficient momentum to break BRN Spot, located very closely.

WT BOF of IRL was a good signal. But the clear swing high for entry was available only in the middle of the Range and hence skipped this.

3) Price action at RN:

Orders accumulated above IRH spiked the price above RN. Kept a buy order at the swing high, it was not filled as the price reversed confirming BOF. Took this BOF exactly at the swing low, before the IRH was broken. Was in 2 minds, first the trade is directed into the chop zone and secondly, the probability of Friday en masse exit of critical mass (long) too hot to resist. Took the trade with a plan to exit, at the first sign of hurdle. Exited with 3.5 points - 3 points for broker and 0.5 point for me.

4) BPB of RN was the signal of the day. But it was nearing 3.00 PM and Margin shortfall didn't let me take this trade.

Followed my system correctly and that was the positive going forward. Discipline and focus will reward in the long run.